Bitcoin & Crypto Tax Reporting

Blockpit Cryptotax is the most reliable tax software for Bitcoin, forex and cryptocurrency trading. Start now - it's free

Tax Compliance. No Compromises.

Blockpit Cryptotax is exclusively based on an audited tax framework. Our tax reports are fully compliant with the US tax law and provide the highest level of legal security. Thousands of users across the United States trust Blockpit Cryptotax.

Save Tax on Bitcoin & Cryptos.

Sell coins tax-free? Offset losses against profits?

You don't have to be a tax professional, we have the best possible tax treatment already programmed in.

With Blockpit Cryptotax you get the most out of it and stay on the safe side!

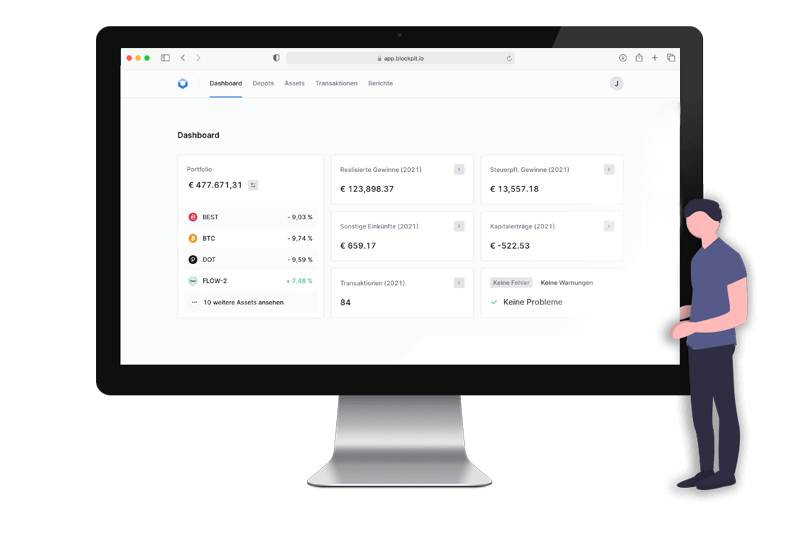

It's That Simple

Data Import

Import data from exchanges and wallets Use our data import to get all your transactions. Automatically keep your portfolio up to date with the API imports.

All Transaction Types

From Airdrops to ZCoin Masternodes - we've got you covered Wonder what to do with all the airdrops? Baking Tezos, delegating Cosmos ATOM and staking NEO? Don't worry, we cover all crypto activities in full compliance with the US tax law!

All Tax Documents

All forms required for your tax filing. Regular reviews of our tax framework by a Big 4 auditing company ensures that all calculations are in accordance with the current state of the law.

Free Support

Get help from our professional support team You can create the report on your own in a short time, as our application will guide you through the process. If you still need help, our support team is at your disposal free of charge.

Become One Of Our Fans!

Taxing crypto-currencies correctly has felt like driving a car without a driver's license for me so far. With Blockpit Cryptotax

I have now found a reliable partner with fair prices and can concentrate 100% on the track - thanks!

Max Hartl

Our Partner Network

FAQ - Frequently Asked Questions

Do I have to pay taxes on Bitcoin?

Yes, cryptos are treated as property for taxation purposes, i.e. the sale or exchange of cryptocurrency or token can lead to a taxable gain.

How to calculate taxes on Bitcoin and other cryptocurrencies?

The sale or exchange of cryptocurrency will result in a net gain or loss and will be taxed as a short-term capital gain at ordinary income tax rates or as long-term capital gain at reduced rates, depending on the amount of time the capital asset is in the hands of the taxpayer (i.e. holding period).

Where can I find a crypto tax calculator?

You can use the Cryptotax Blockpit application, which is much more than just a tax calculator. It makes sure that all your transactions are considered properly according to the US federal tax law and fills out the IRS forms for you. The best thing is that you can use Cryptotax for free!

Are crypto to crypto trades taxable?

Yes, even if you do not have any transaction involving USD, you can realize a capital gain. Hence it is very important to track your tax liability and make sure to have sufficient liquidity to cover the taxes.

Is the IRS able to find out about my cryptos?

Is the IRS able to find out about my cryptos? The IRS has sufficient tools to find out about your cryptos both from domestic and foreign exchanges. You are also required to disclose any engagement with the cryptocurrencies in the 2019 Form 1040.

Can I use Cryptotax anonymously?

Yes! You only need an email, which can be anonymous, to start using Cryptotax.

Do I need a tax advisor for crypto taxes?

With Cryptotax you will usually not need additional help. Our app creates all the documents you need for your tax return. If you still need support from a specialized tax advisor, you can make use of our partner network.

Can I use Cryptotax for free?

Yes, you can use all features of Cryptotax free of charge, if you have up to a total of 50 transactions. When moon? Very soon 😎 🚀

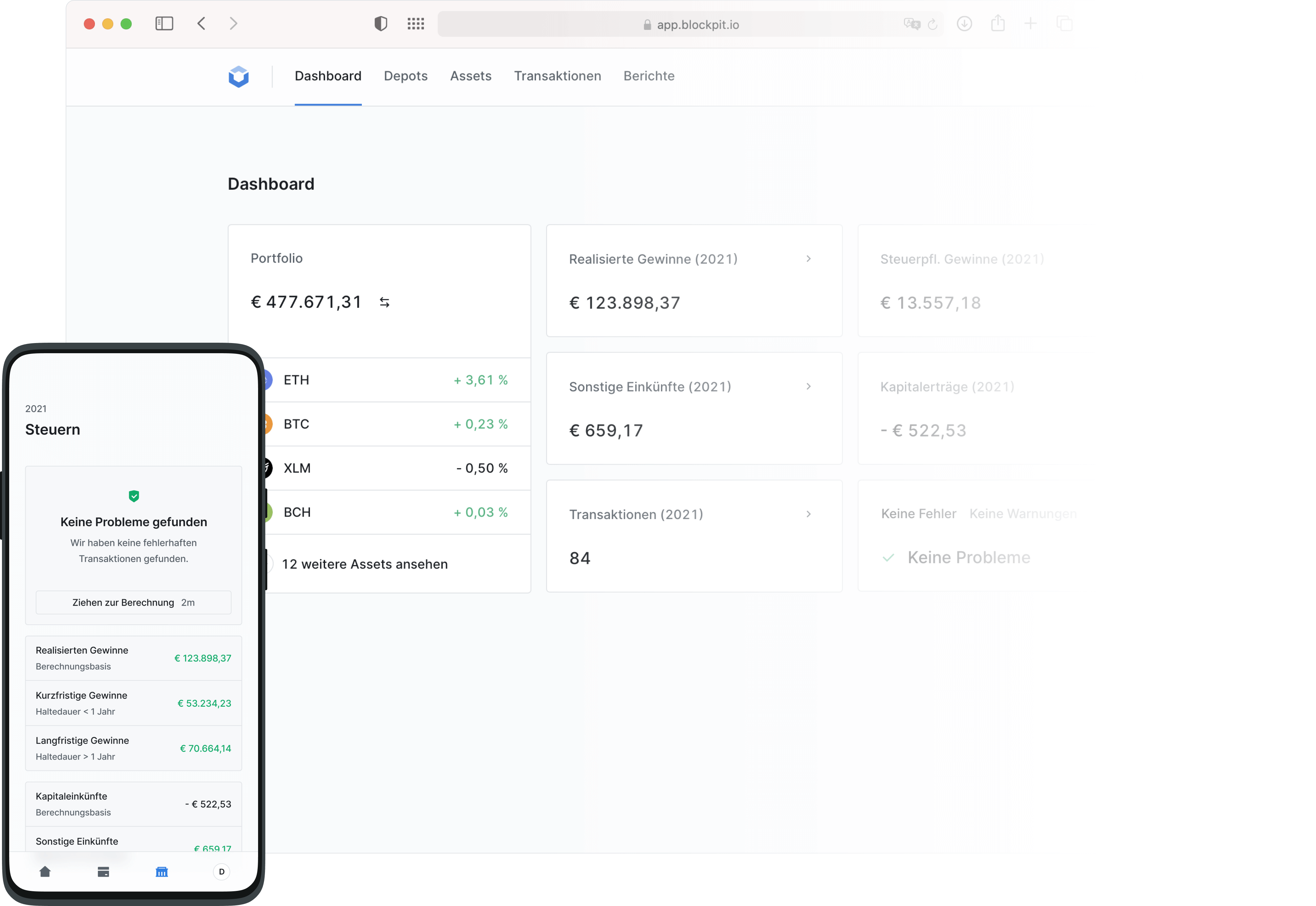

Portfolio tracking and tax filing made easy

We'll help you handle taxes on Bitcoin & co.